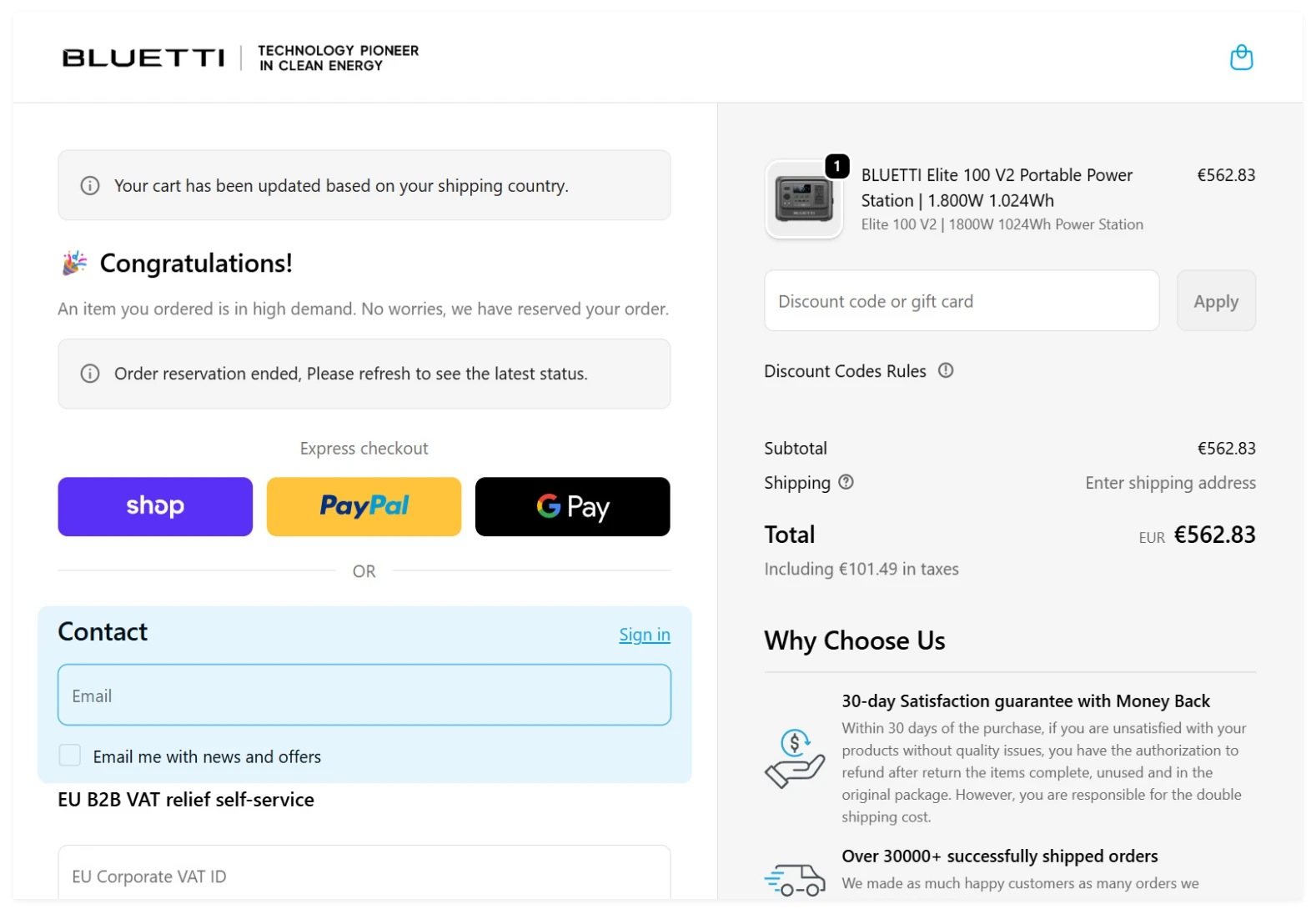

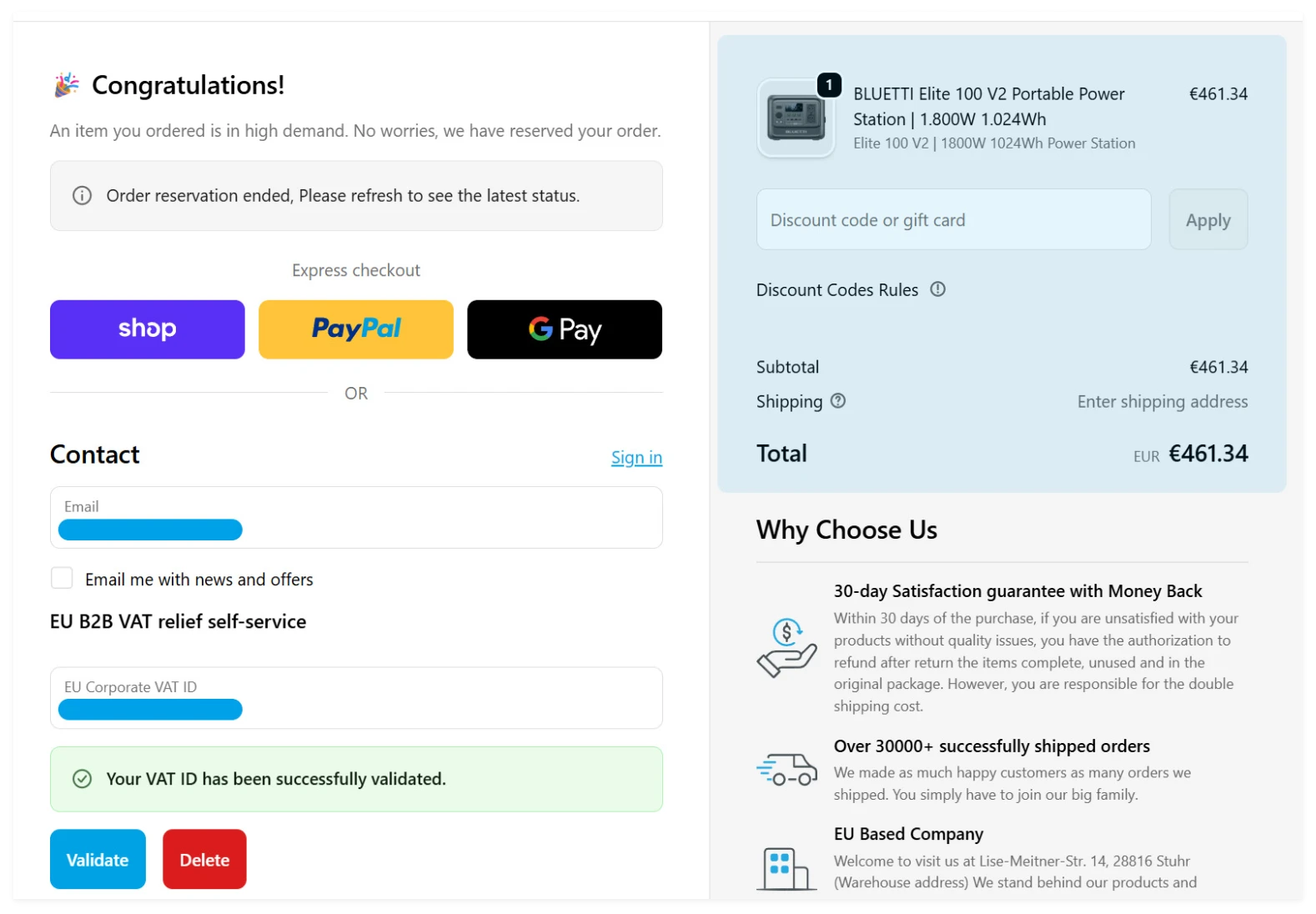

Automatic VAT-Free Checkout

Note: Applies only to EU countries outside Germany. For German VAT inquiries, please contact us at sale-de@bluettipower.com.

Checkout VAT-Free-

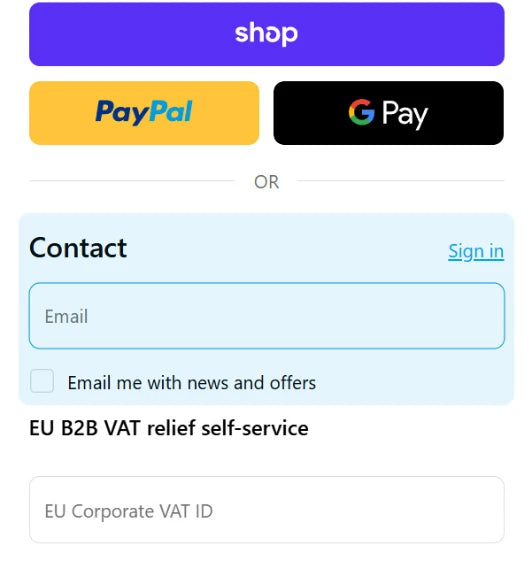

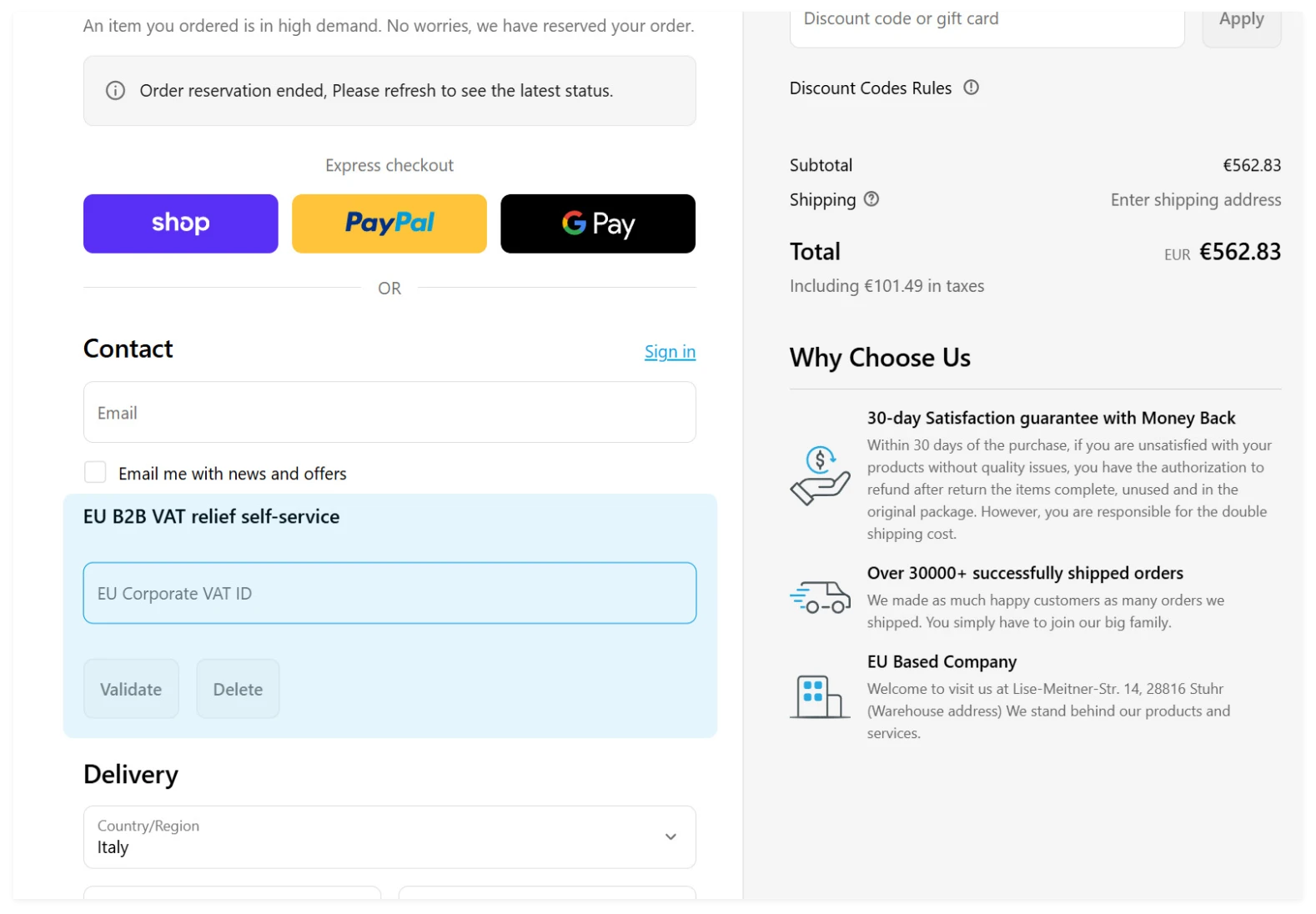

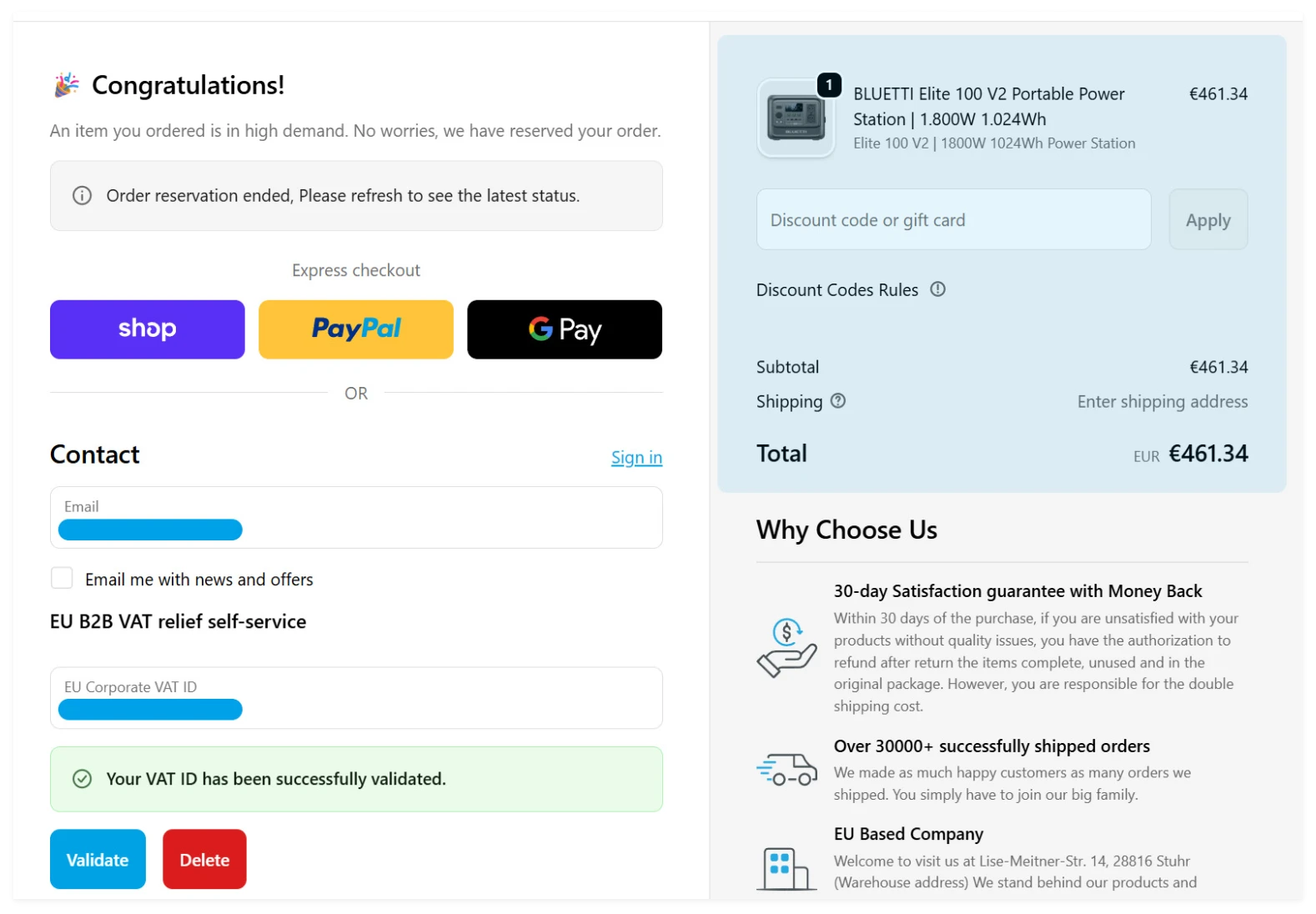

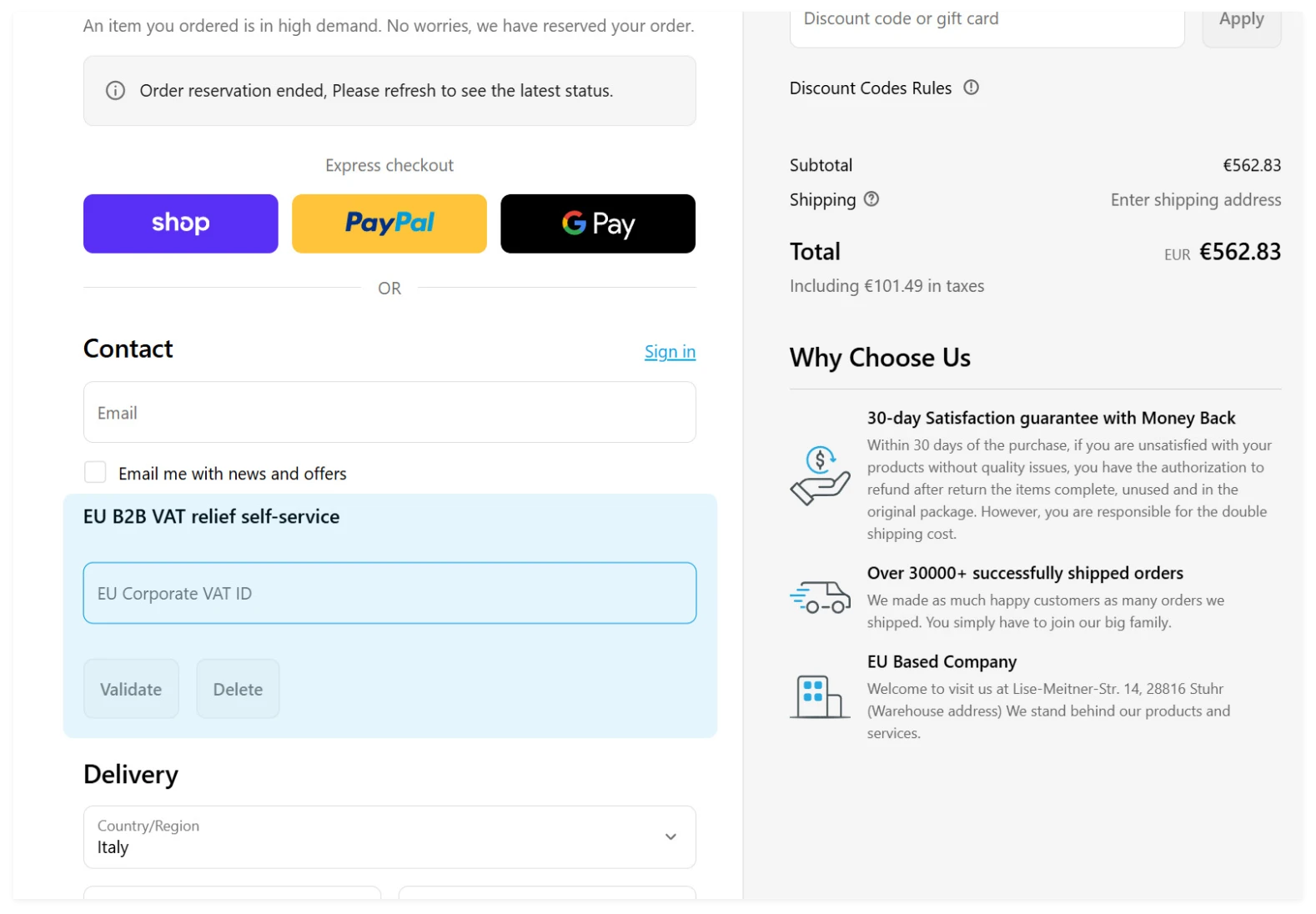

Step 1: Provide BLUETTI Account Email

Use the email linked to your EU BLUETTI account. No account? [Create one here].

-

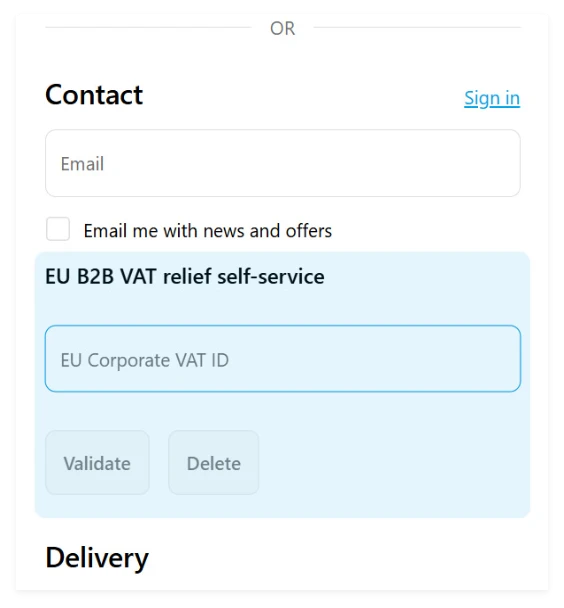

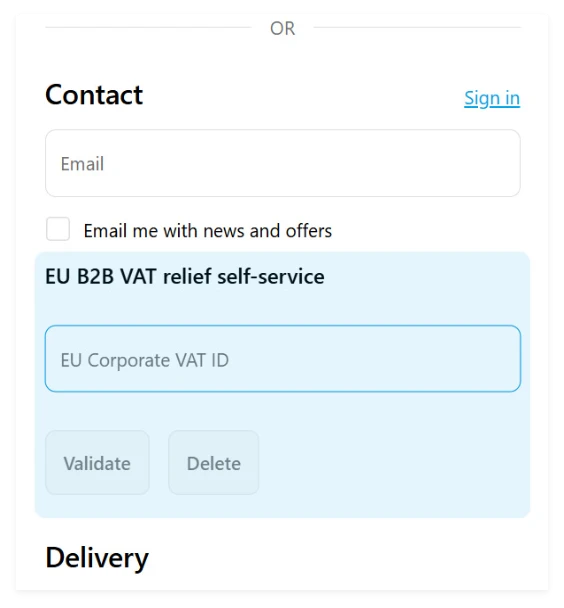

Step 2: Verify VAT Number

Provide a valid VAT number for automatic verification. Example: IT00000000000 (Country prefix IT + 11 digits)

-

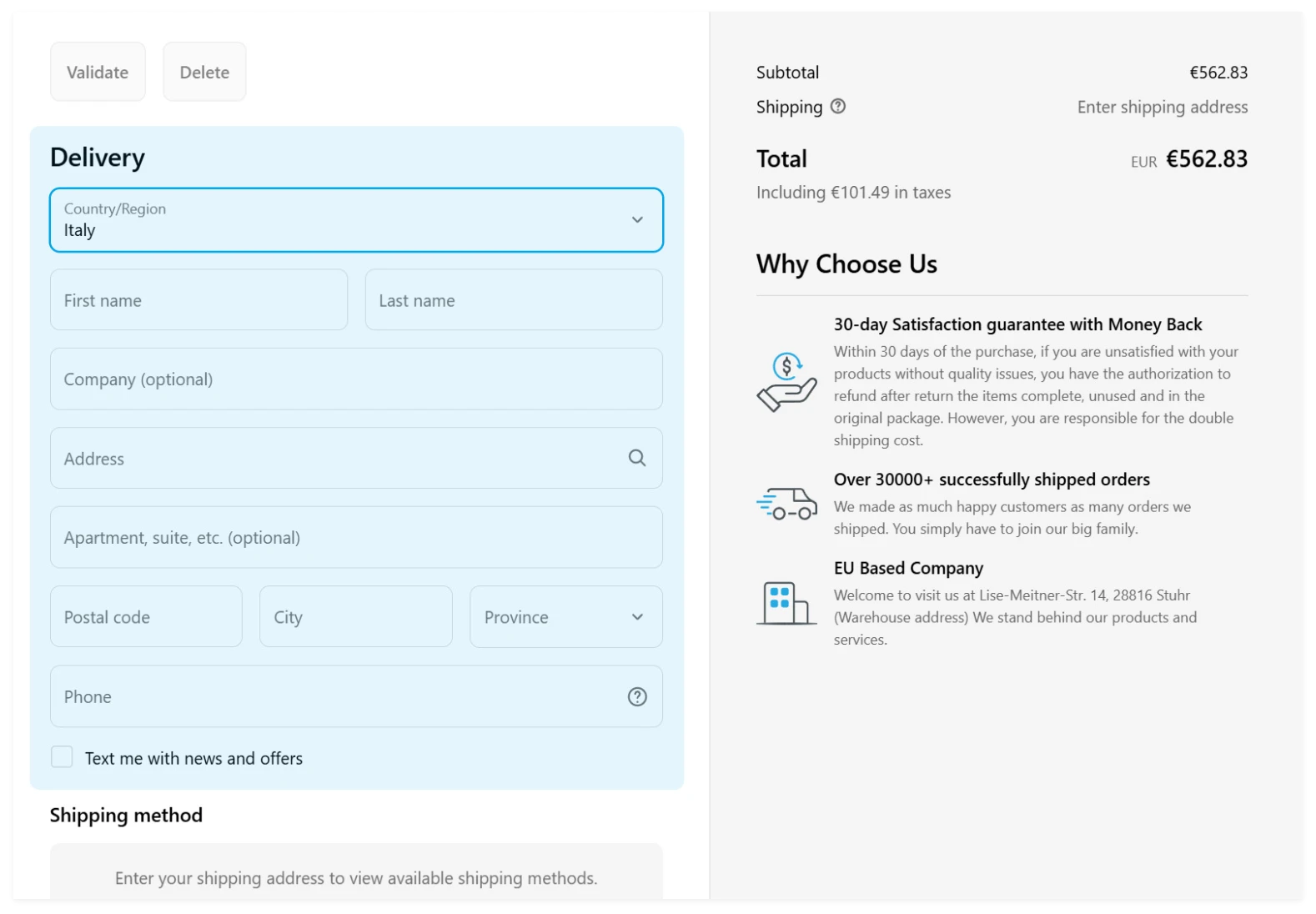

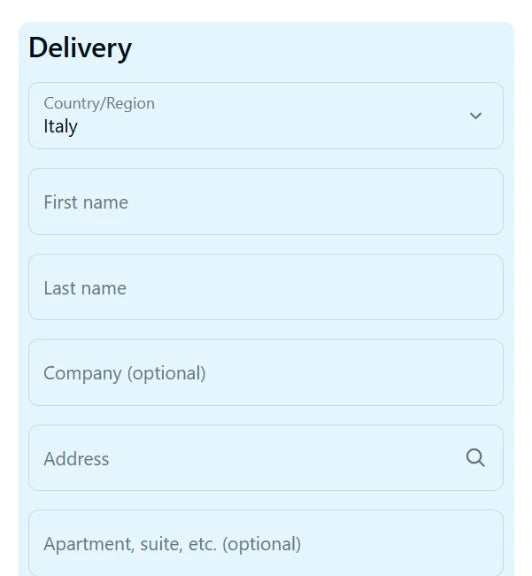

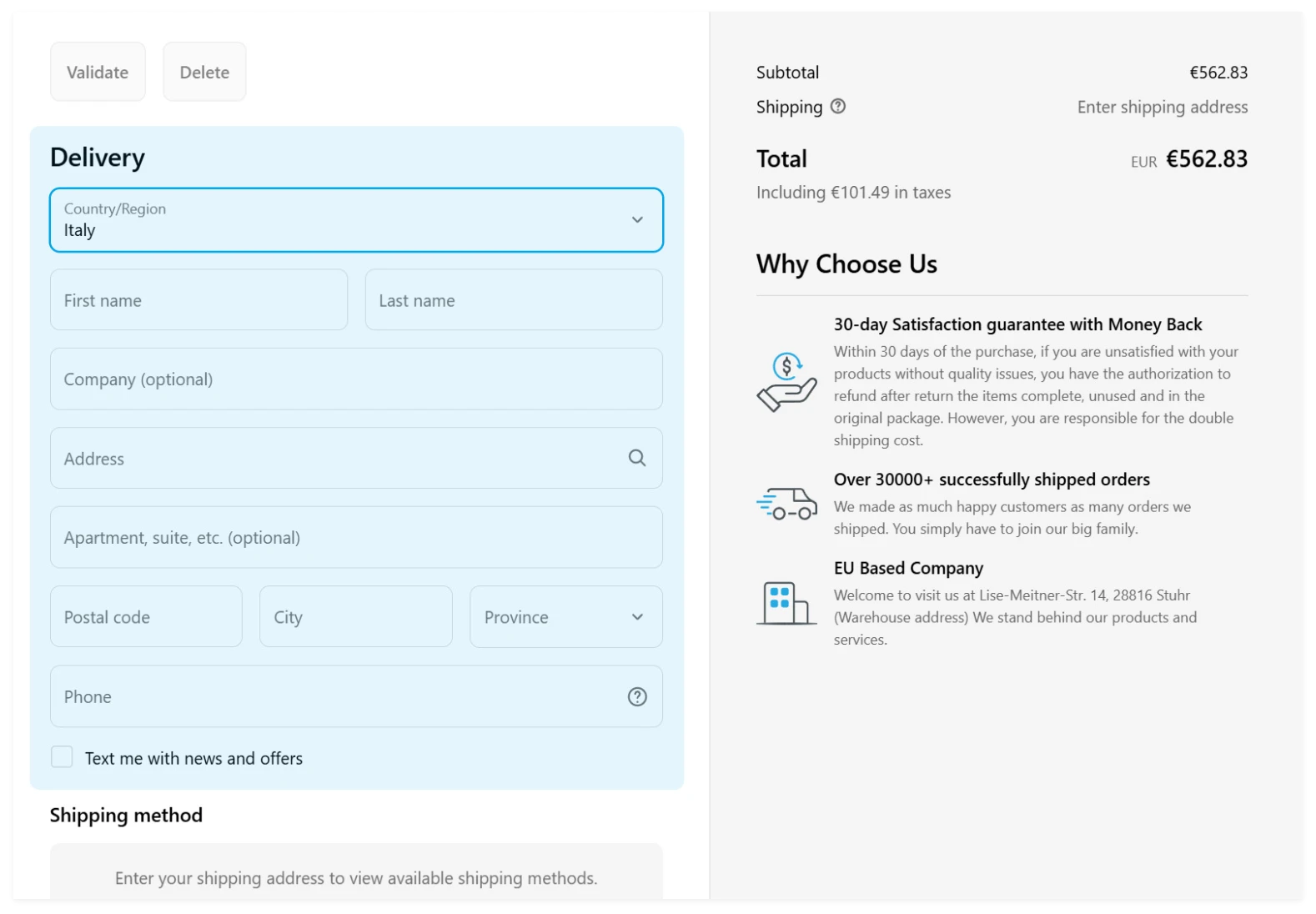

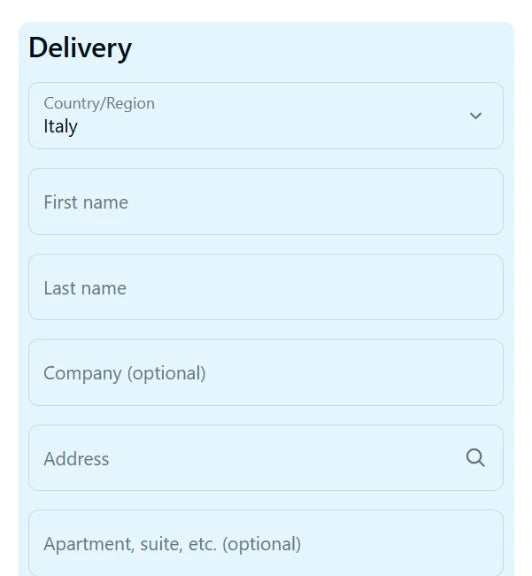

Step 3: Add Shipping Info

Fill in your shipping details, including your country, street address, city, ZIP code, and phone number.

-

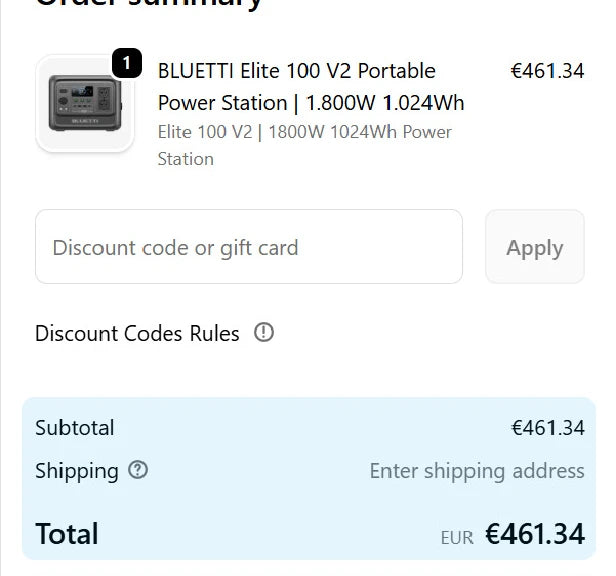

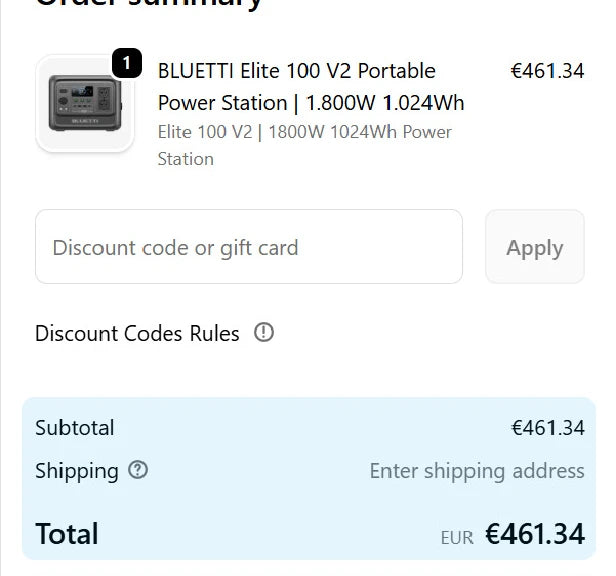

Step 4: Confirm VAT-Free Price

Review your checkout price. If VAT exemption applies, it will match your local VAT savings.

Checkout VAT-Free

Request a Tax Exemption or Refund

Choose Tax-Free Before Payment or Tax Refund After Payment, fill out the form, and submit. We'll email a tax-free link

for pre-payment or issue your refund for post-payment within 1–3 business days.

Tax-Free Before Payment

Tax Refund After Purchase

Featured Products

Elite 200 V2

2.600 W | 2.073,6 Wh

Apex 300

3.840 W | 2.764,8 Wh

Frequently Asked Questions

-

- 1. Who is eligible for tax exemption?

- Verified business owners from eligible countries/regions with a valid VAT ID.

- 2. Which countries/regions and VAT rates apply?

- Austria (20%), Belgium (21%), Bulgaria (20%), Germany (19%), Denmark (25%), Estonia (24%), Spain (21%), Finland (26%), France (20%), Croatia (25%), Hungary (27%), Ireland (23%), Italy (22%), Lithuania (21%), Luxembourg (17%), Latvia (21%), Netherlands (21%), Poland (23%), Portugal (23%), Romania (19%), Sweden (25%), Slovenia (22%), Slovakia (23%), Czech Republic/Czechia (21%), Cyprus(19%), Malta(18%).

- 3. What products qualify?

- All products sold in the BLUETTI EU store.

- 4. Why can't I see VAT-free pricing on product pages even after logging in?

- VAT-free prices appear only at checkout after entering a valid BLUETTI account email and VAT ID on BLUETTI.EU website. If it's not applied, your VAT ID may be unverified. Contact sale-eu@bluettipower.com for assistance.

- 5. Why is my VAT number showing as invalid?

-

1. Check the format: Country prefix + digits

Example Italy: IT00000000000 (Prefix IT + 11 digits)

2. Validate through the official VIES system.

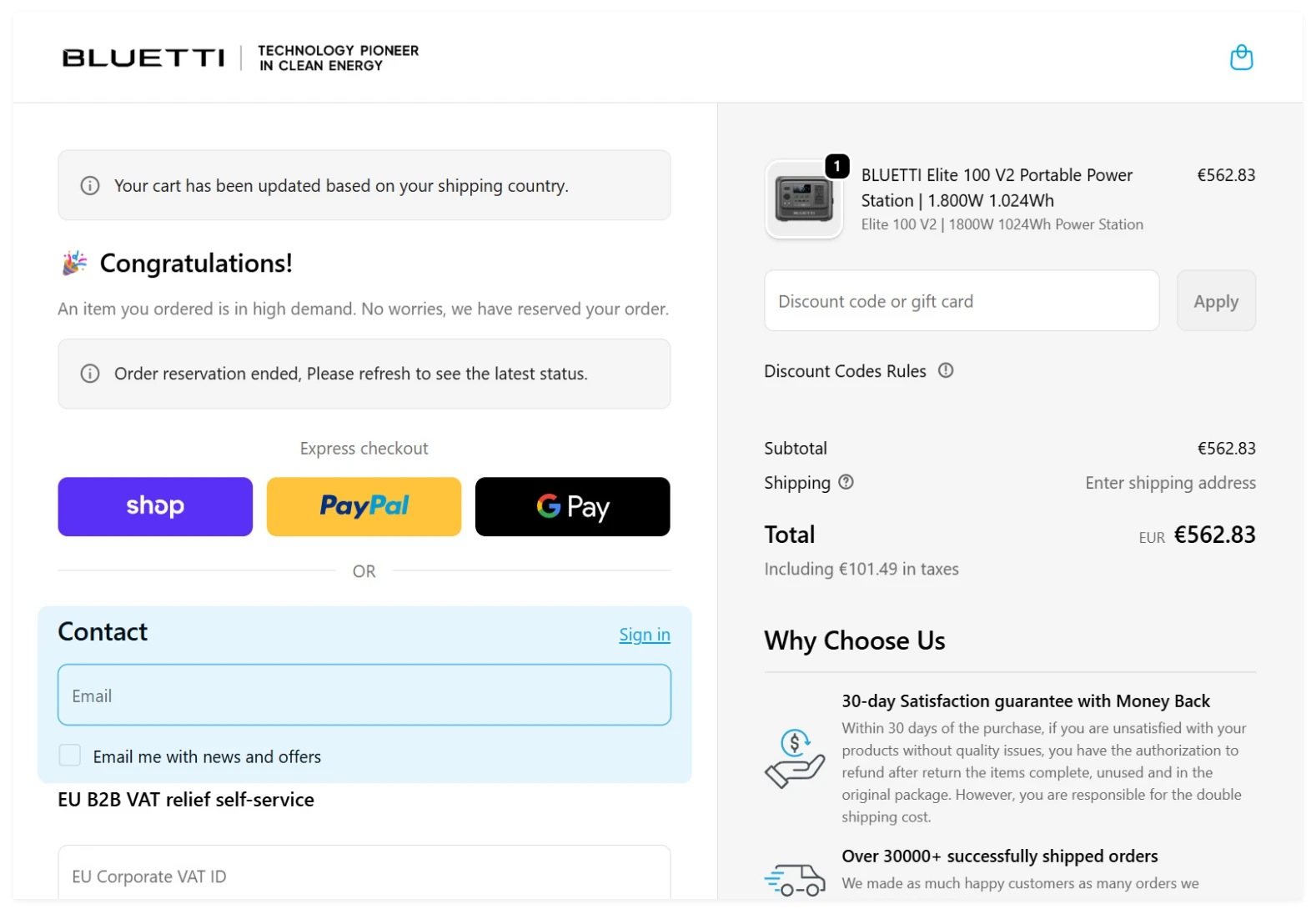

- 6. Why is the checkout tax-inclusive price different from the product page?

-

Product pages display prices with German VAT (19%) by default. At checkout, the price automatically updates to reflect your country's VAT rate.

*Price with VAT = Base price × (1 + VAT rate)

- 7. How to get a refund for past orders?

- Reach out at sale-eu@bluettipower.com with your order details and VAT ID.

- 8. What's the difference between tax-inclusive and tax-free invoices?

- Invoices with VAT show the tax amount. For tax-free orders, if you need VAT info added to your invoice, please contact us at sale-eu@bluettipower.com.

- 9. How does the VAT refund process work for customers from a non-EU country?

- Since Ukraine/Switzerland/Norway are not EU members, customers may request a VAT refund only under non-EU resident rules. Please apply for an invoice with a Ukraine/Switzerland/Norway billing address from the seller, and then the buyer must provide customs-stamped export documents and proof of non-EU residency. All documents must be sent to the seller in advance for validation before sending anything to the German office. If the customer’s documents are invalid, the refund cannot be processed.

Legal & Compliance Notice

(1) Disclaimer: Tax-exempt checkout is available only to EU-registered businesses with a valid VAT number. Individual consumers (B2C) are not eligible.

(2) VAT Number Compliance: Provide a valid, accurate VAT number. Supplying a false or invalid VAT ID, or abusing tax-exempt checkout, may lead to tax recovery, legal action, order refusal, and/or direct investigation by tax authorities.

(3) Exchange Rates & VAT Changes: Checkout totals may vary due to local VAT rates and currency fluctuations. The final price is determined at the time of checkout.

(4) Verification: Tax exemption depends on successful validation of the buyer's VAT registration via the EU Exemptify system. For additional VAT ID checks, use the EU VIES service.